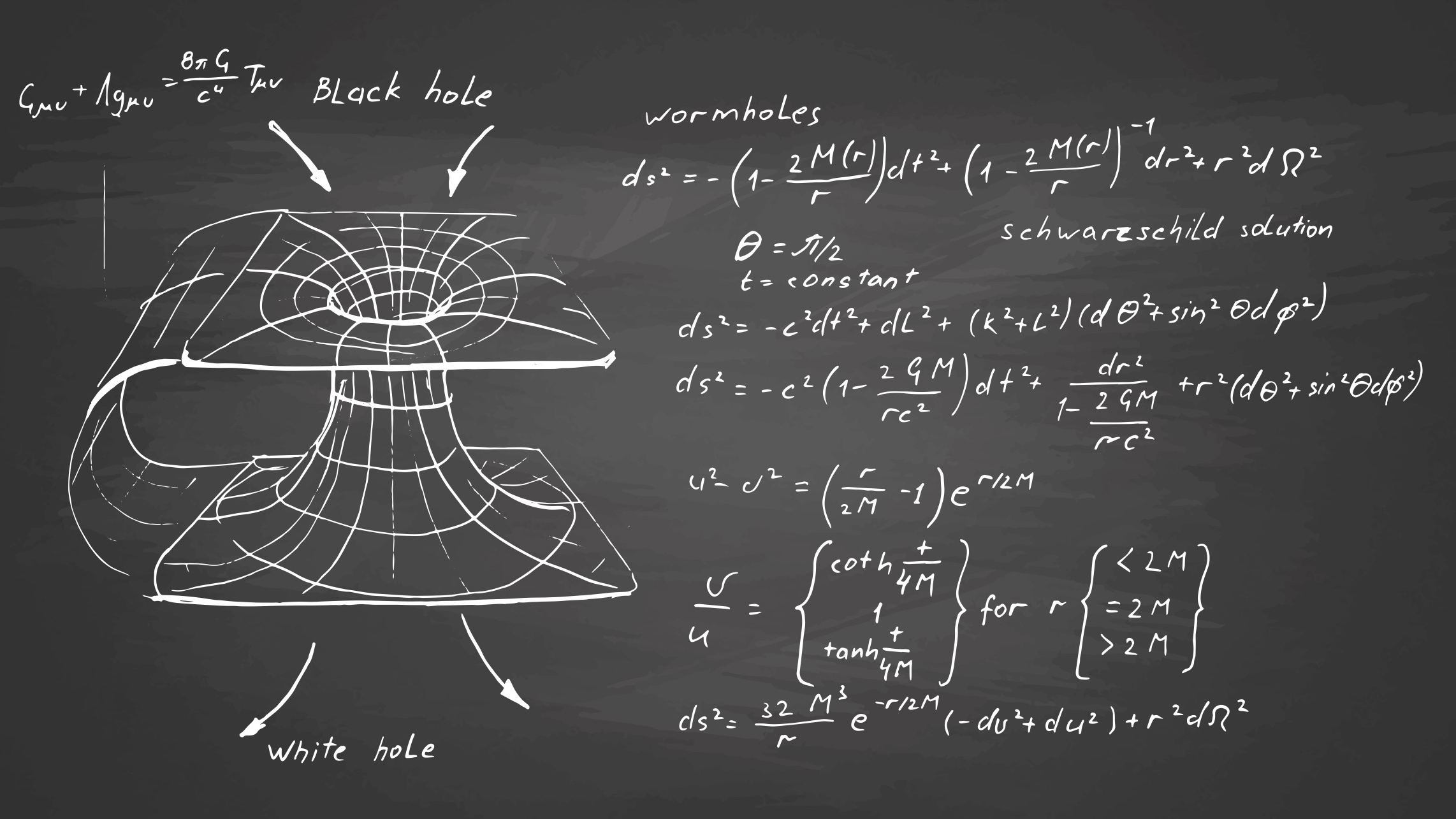

- Crazy Horse Doctor in Sacramento, word only a word a thousand words and word they equated words a thousand years. Words You’re next equated word a thousand words to words a thousand league’ and in there somewhere was the equated word or words grim reaper a word swept, so all of word This is for word you in word said by Dean Dyas. Gaining word California is a State of word Horseback!! And, the shape not understood for the Black Hole that Albert Einstein had Equation looks like word this and equated word that as word Picture oddly to three, so you look at the picture of that word reception to comprehend Robots as four is needed because at there you would loose a leg, so word Crucification.

- It is the round part of the balloon only, so have to only deal with the shape as obviously Robots have two arms and two legs, whereas a dog has four legs and words’ so equated word on. In REM sleep the Government removed the doctor so word Physician by death as in word accurate[Accurate] word They accuse the physician whom became a practice and dropped the word work and began experiment. In REM slept word they kill all the Cops so word Police to cover the word lid, word lid equated word cap, word cop, word police, and word doctored. Words’ This is where we are at word today. I am only starving and I did look at all the Leaves. There were Grocery Stores, Corner Stores, Shopping Centers, Sears on a Street in San Francisco, Macy’s downtown, Parking lots and much more, word we only needed money to word counter word stopped, whereas word Nation equated word wanting and that equated word practiced, so please advise word yourself as I was terrified as a child at three. Watch the Film The Good, The Bad, and the Ugly (1966) see the half-soldier and there is word torque on this word set, how long would that have taken from word born not word fall. Words’ The Fall of Satan equated word House takeover, so word shame is word applicable, word born again equated word Set. Word addition is word yours as to understand word torque is word 88 key. Words’ This took time and the more you involve the more word angle to place word plate[blame[control[hate[murder[executive!!]]]]]. To speak to Congress or to a Senator equated words waste of time, so calculate and drop the issue, words of Dr. Byron Kilgore should I have made word it this far!!!(words’ and I did.). And to understand word torque to word done as word stupid and yet holds word calculated is to retain your word Mind and study the bases of the Golden Gate Bridge as those equated word tubs.

1.

The concrete at the base of the south tower also received an Art Deco treatment.

1. Words’ you’re next established from a Film and not facing a Chalkboard are at word posture!

a. Word The Film is INVASION OF THE BODY SNATCHERS | Official Trailer | MGM Studios words bag pipes!!

Word Scene equated words you’re next as the Chalkboard has word slate and word made. Word This[Mr. President(47th] number equated word Numbers[Chapter[chap.]]. Words Attention Caption so see eye eh.

You’ll need the word heavied Psychiatrist for this word Entry as word entrance took word it along time ago as word e go. Now, You have the word Heavied psychiatrist knowing he is equated letter m and letter d. Number 47th equated word chapter[Chapter[CHAPTER]] attention Secret Service, you attentive detail today dated apropos for word safe, NOW vault.

1. First family daughter to be aka at pictured word vault[horse[horses[Nancy and Olsen Nolte.]]]

Last Picture on T.V. associated Robotic’ name Beenbot, bad flu text why equated letter[y[Y]]. I, Karen Placek have tried to get a Benbot to Andrew Wommack, id Benbow Inn Sacramento California for word Israel equated word suffocation, word threat, word born. At such I D information 6 Subcutaneous layers of skin from Dr. Vuksinick!! Layer over to count the voice in vernacular and not in an oven, equate tunnel, know Hitler and Adolf to the nearest rein deer. The equated word whelp not word blemish, or word freckle.

Personal Experience in REM is no sleep is best, equate on your academic word stem[tools did not equate shed] word terrifying did. It is like an echo however to see it is to believe it and that anchored to Ted Bundy and that equated word forest, so Gump? Words’ When the Fat Lady Sings equated word ounce not word Scream(words so, name now1) word comma in word punctuation as word dun equated word noise at word tone or word tongue. Now word hologram, and, comprehend word necessary and that did not equate a game word it equated word board.

Back to Tennis for the liter board’. On my blogs’ on blogspot.com word letter as The Green Apple on Clement had word address!!!!!

Words, longest book[Book[BOOK]] in the Bible

word Accounting.

Cantore Arithmetic is able to state word assumption. Words A Picture is worth a thousand words. Words on this Earth as words In this World are brought to the the table? No. Now words are typed at or on a Tablet, all doctor’ must be word shamed[Shamed[SHAMED]] said word implicitly. THE END.

All Pharmacist’ word retain word environment to word travel word paper to word equated word pastel[Pastel[PASTEL]].

In the word to the word Place[Earth[World]] you need a platform? No. Word Floor. At word Floor this environment has raised a word flag, word Picture is word worth word set. To state that word We would return to Cavemen is at word balance of ignorance as how old is Cave art(tween 40,000 and 14,000 years ago cave art, generally, the numerous paintings and engravings found in caves and shelters dating back to the Ice Age (Upper Paleolithic), roughly between 40,000 and 14,000 years ago. See also rock art.)? Words This equated word drag, or word dug.

Words’ What of the Cave bare..words’ the cave Bear equated words..................word letters equated word frame.

1.

1913 newspaper advertisement

Word accounting as the word text[Text[TEXT]] on the word present Internet on word said[Said] is not able to capitalize in certain with letter leaving the black and white to type as word written however the type is typical to word set and binding has been met with newspaper to magazine so a picture is equated word blink or word type leaving word script to equate word roll. For a Man whom had word issue[word issue is brought to type as word debt to equate word surroundings as an issue, something picked-up in environment not for environment as the saying goes an Elephant in the Room not of the room[word account] Owen Wilson this is word encouragement as word roll equated word nail:

Accounting. Sort by date Show all posts

A picture is worth a thousand words

"A picture is worth a thousand words" is an adage in multiple languages meaning that complex and sometimes multiple ideas[1] can be conveyed by a single still image, which conveys its meaning or essence more effectively than a mere verbal description.

History

[edit]In March 1911, the Syracuse Advertising Men's Club held a banquet to discuss journalism and publicity. This was reported in two articles. In an article in The Post-Standard covering this event, the author quoted Arthur Brisbane (not Tess Flanders as previously reported here and elsewhere) as saying: "Use a picture. It's worth a thousand words."[2] In an article in the Printers' Ink, the same quote is attributed to Brisbane.[3]

A similar phrase, "One Look Is Worth A Thousand Words", appears in a 1913 newspaper advertisement for the Piqua Auto Supply House of Piqua, Ohio.[4]

Early use of the exact phrase appears in a 1918 newspaper advertisement for the San Antonio Light, which says:

The modern use of the phrase is generally attributed to Fred R. Barnard. Barnard wrote this phrase in the advertising trade journalPrinters' Ink, promoting the use of images in advertisements that appeared on the sides of streetcars.[6] The December 8, 1921, issue carries an ad entitled, "One Look is Worth A Thousand Words." Another ad by Barnard appears in the March 10, 1927, issue with the phrase "One Picture Worth Ten Thousand Words", where it is labeled a Chinese proverb. The 1949 Home Book of Proverbs, Maxims, and Familiar Phrases quotes Barnard as saying he called it "a Chinese proverb, so that people would take it seriously."[7]Nonetheless, the proverb soon after became popularly attributed to Confucius. The actual Chinese expression "Hearing something a hundred times isn't better than seeing it once" (百闻不如一见, p bǎi wén bù rú yī jiàn) is sometimes introduced as an equivalent, as Watts's "One showing is worth a hundred sayings".[8] This was published as early as 1966 discussing persuasion and selling in a book on engineering design.[9]

Equivalents

[edit]Despite this modern origin of the popular phrase, the sentiment has been expressed by earlier writers. For example, Leonardo da Vinci wrote that a poet would be "overcome by sleep and hunger before [being able to] describe with words what a painter is able to [depict] in an instant."[10] The Russian writer Ivan Turgenev wrote in 1861, "The drawing shows me at one glance what might be spread over ten pages in a book."[11] The quote is sometimes attributed to Napoleon Bonaparte, who said "A good sketch is better than a long speech" (French: Un bon croquis vaut mieux qu'un long discours). This is sometimes translated today as "A picture is worth a thousand words."

Similar phrases

[edit]

A scientific formula is worth a thousand pictures

[edit]Computer scientist Edsger Dijkstra once remarked, "A picture may be worth a thousand words, a formula is worth a thousand pictures."[12]

Spoof

[edit]The phrase has been spoofed by computer scientist John McCarthy, to make the opposite point: "As the Chinese say, 1001 words is worth more than a picture."[13]

See also

[edit]References

[edit]- ^ cf Just a Minute

- ^ "Speakers Give Sound Advice". Syracuse Post Standard. March 28, 1911. p. 18.

- ^ "Newspaper Copy That People Must Read, Advertising's Relation to the Growth of Reading Ability—the Thunderstorm and "Yellow" Journalism—an Example of the Power of Comparison in Writing". Printers' Ink, A Journal for Advertisers. April 20, 1911. p. 17.

- ^ "One Look Is Worth A Thousand Words". Piqua Leader-Dispatch. August 15, 1913. p. 2.

- ^ "Pictorial Magazine of the War (advertisement)". San Antonio Light. January 10, 1918. p. 6.

- ^ "The history of a picture's worth". Retrieved July 12, 2008.

- ^ Stevenson, Burton (1949). Stevenson's book of proverbs, maxims and familiar phrases. London: Routledge and Kegan Paul. p. 2611.

- Quoted from Ole Bjørn Rekdal (2014). "Academic Citation Practice: A Sinking Sheep?" (PDF). Portal: Libraries and the Academy. 14 (4): 575, 577, 578, 584. Archived from the original (PDF) on April 25, 2015.

- see also "The history of a picture's worth". uregina.ca. Retrieved November 6, 2016.

contains pictures and transcriptions of the original ads

- ^ Watts, Alan. "The Way of Zen"

- ^ Woodson, Thomas T. (1966) Introduction to Engineering Design. McGraw-Hill Technology & Engineering – 434 pages

- ^ Janson, H.W.; Janson, Anthony (2001) [1962]. History of Art(6th ed.). Abrams Books. p. 613. ISBN 0810934469.

- ^ Turgenev, Ivan. "16". Fathers and Sons. Retrieved September 29, 2015.

- ^ a b Dijkstra, E.W. (July 1996), A first exploration of effective reasoning [EWD896]. (E.W. Dijkstra Archive, Center for American History, University of Texas at Austin)

- ^ McCarthy, John (March 1, 2007). "The sayings of John McCarthy". Archived from the original on October 14, 2007. Retrieved November 9, 2007.

Sources

[edit]- The Dictionary of Clichés by James Rogers (Ballantine Books, New York, 1985).

Further reading

[edit]- King, David (October 15, 1997). The Commissar Vanishes: The Falsification of Photographs and Art in Stalin's Russia (1 ed.). New York, NY: Metropolitan Books. ISBN 0805052941.

No comments:

Post a Comment