What dagger made way to discussion of the county versus the boarder of a town or country lane? The platter of commerce? Did the person to person Ma Bell ("as in Mother Bell") make that a party-line? Is it the call-interrupt to the break-up of Ma Bell that made people not person to person, and, did that break-up make 911?

What is the distraction of my country that has made phones the majesty? As salutes wake and sleep to those necessities what than is the difference from the old-timey party-line? To make this more of a friendly fire conversation, how does the rate fee?

The fact that the Liberty Bell (https://www.nps.gov/inde/learn/historyculture/stories-libertybell.htm) cracked and now it represents the phone company nationwide and readily seen, moreover and for friction relief, the fact, immigrants would believe that the phone company may indeed be our Liberty Bell, or, is that just coincidence that the logos is the same or in basic also has the appearance of our Liberty Bell (https://www.nps.gov/inde/learn/historyculture/stories-libertybell.htm) in our history? And now that Liberty is no longer in the Town Square for the ringing-of where is the collection of noise and or ring to answer should you not be on the other end of the line?

Pyramid scheme

Jump to navigation

Jump to search

This article needs additional citations for verification. (January 2016) (Learn how and when to remove this template message)

|

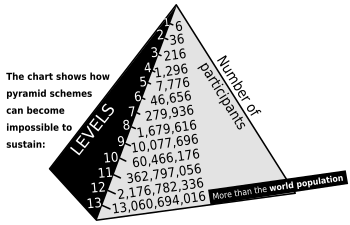

The unsustainable exponential progression of a classic pyramid scheme (here with a branching factor of 6)

Pyramid schemes have existed for at least a century in different guises. Some multi-level marketing plans have been classified as pyramid schemes.[1]

Contents

Concept and basic models

In a pyramid scheme, an organization compels individuals who wish to join to make a payment. In exchange, the organization promises its new members a share of the money taken from every additional member that they recruit. The directors of the organization (those at the top of the pyramid) also receive a share of these payments. For the directors, the scheme is potentially lucrative—whether or not they do any work, the organization's membership has a strong incentive to continue recruiting and funneling money to the top of the pyramid.Such organizations seldom involve sales of products or services with value. Without creating any goods or services, the only revenue streams for the scheme are recruiting more members or soliciting more money from current members. The behavior of pyramid schemes follows the mathematics concerning exponential growth quite closely. Each level of the pyramid is much larger than the one before it. For a pyramid scheme to make money for everyone who enrolls in it, it would have to expand indefinitely. This is not possible because the population of Earth is finite. When the scheme inevitably runs out of new recruits, lacking other sources of revenue, it collapses. Because in a geometric series, the biggest terms are at the end, most people will be in the lower levels of the pyramid (and indeed the bottom level is always the biggest single layer).

In a pyramid scheme, people in the upper layers typically profit while people in the lower layers typically lose money. Since at any given time, most of the members in the scheme are at the bottom, most participants in a pyramid scheme will not make any money. In particular, when the scheme collapses, most members will be in the bottom layers and thus will not have any opportunity to profit from the scheme, yet they will have paid to join the scheme. Therefore, a pyramid scheme is characterized by a few people (including the creators of the scheme) making large amounts of money, while most who join the scheme lose money. For this reason, they are considered scams.[2]

The "eight ball" model

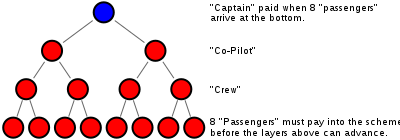

The "eight-ball" model contains a total of fifteen members. Note that in an arithmetic progression 1 + 2 + 3 + 4 + 5 = 15. The pyramid scheme in the picture in contrast is a geometric progression 1 + 2 + 4 + 8 = 15.

Prior instances of this scheme have been called the "Airplane Game" and the four tiers labelled as "captain", "co-pilot", "crew", and "passenger" to denote a person's level. Another instance was called the "Original Dinner Party" which labeled the tiers as "dessert", "main course", "side salad", and "appetizer". A person on the "dessert" course is the one at the top of the tree. Another variant, "Treasure Traders", variously used gemology terms such as "polishers", "stone cutters", etc.

Such schemes may try to downplay their pyramid nature by referring to themselves as "gifting circles" with money being "gifted". Popular schemes such as "Women Empowering Women"[3] do exactly this.

Whichever euphemism is used, there are 15 total people in four tiers (1 + 2 + 4 + 8) in the scheme—with the Airplane Game as the example, the person at the top of this tree is the "captain", the two below are "co-pilots", the four below are "crew", and the bottom eight joiners are the "passengers".

At ten levels deep, the "airplane game" has an 87% loss rate.

If a person is using this model as a scam, the confidence trickster would take the majority of the money. They would do this by filling in the first three tiers (with one, two, and four people) with phony names, ensuring they get the first seven payouts, at eight times the buy-in sum, without paying a single penny themselves. So if the buy-in were $5,000, they would receive $40,000, paid for by the first eight investors. They would continue to buy in underneath the real investors, and promote and prolong the scheme for as long as possible to allow them to skim even more from it before it collapses.

Although the "captain" is the person at the top of the tree, having received the payment from the eight paying passengers, once they leave the scheme they are able to re-enter the pyramid as a "passenger" and hopefully recruit enough to reach captain again, thereby earning a second payout.

Matrix schemes

Matrix schemes use the same fraudulent, unsustainable system as a pyramid; here, the participants pay to join a waiting list for a desirable product, which only a fraction of them can ever receive. Since matrix schemes follow the same laws of geometric progression as pyramids, they are subsequently as doomed to collapse. Such schemes operate as a queue, where the person at head of the queue receives an item such as a television, games console, digital camcorder, etc. when a certain number of new people join the end of the queue. For example, ten joiners may be required for the person at the front to receive their item and leave the queue. Each joiner is required to buy an expensive but potentially worthless item, such as an e-book, for their position in the queue. The scheme organizer profits because the income from joiners far exceeds the cost of sending out the item to the person at the front. Organizers can further profit by starting a scheme with a queue with shill names that must be cleared out before genuine people get to the front. The scheme collapses when no more people are willing to join the queue. Schemes may not reveal, or may attempt to exaggerate, a prospective joiner's queue position, a condition that essentially means the scheme is a lottery. Some countries have ruled that matrix schemes are illegal on that basis.Relation to Ponzi schemes

While often confused for each other, pyramid schemes and Ponzi schemes are different from each other. They are related in the sense that both pyramid and Ponzi schemes are forms of financial fraud.[4] However, pyramid schemes are based on network marketing, where each part of the pyramid takes a piece of the pie / benefits, forwarding the money to the top of the pyramid. They fail simply because there aren't sufficient people. Ponzi schemes, on the other hand, are based on the principle of "Robbing Peter to pay Paul"—early investors are paid their returns through the proceeds of investments by later investors. In other words, one central person (or entity) in the middle taking money from one person, keeping part of it and giving the rest to others who had invested in the scheme earlier. Thus, schemes such as the Anubhav teak plantation scheme (teak plantation scam of 1998) in India can be called Ponzi schemes. Some Ponzi schemes can depend on multi-level marketing for popularizing them, thus forming a combination of the two.[5]Connection to multi-level marketing

Some multi-level marketing (MLM) companies operate as pyramid schemes and consumers often confuse legitimate multi-level marketing with pyramid schemes.[1][6][7][8]According to the U.S. Federal Trade Commission legitimate MLM, unlike pyramid schemes:

- "have a real product to sell."[9] "Not all multilevel marketing plans are legitimate. If the money you make is based on your sales to the public, it may be a legitimate multilevel marketing plan. If the money you make is based on the number of people you recruit and your sales to them, it’s probably not. It could be a pyramid scheme."[10]

The Federal Trade Commission warns, "It’s best not to get involved in plans where the money you make is based primarily on the number of distributors you recruit and your sales to them, rather than on your sales to people outside the plan who intend to use the products."[16] It states that research is your best tool and gives eight steps to follow:

- Find—and study—the company's track record.

- Learn about the product.

- Ask questions.

- Understand any restrictions.

- Talk to other distributors. Beware of shills.

- Consider using a friend or adviser as a neutral sounding board, or for a gut check.

- Take your time.

- Think about whether this plan suits your talents and goals.[16]

Legality

Pyramid schemes are illegal in many countries or regions including Albania, Australia,[20][21] Austria,[22] Belgium,[23] Bahrain, Brazil, China,[24] Colombia,[25] Denmark, the Dominican Republic,[26] Estonia,[27] Finland,[28] France, Germany, Hong Kong,[29] Hungary, Iceland, India, Iran,[30] the Republic of Ireland,[31] Italy,[32] Japan,[33] Malaysia, Maldives, Mexico, Nepal, the Netherlands,[34] New Zealand,[35] Norway,[36] Peru, Philippines,[37] Poland, Portugal, Romania,[38] Russian Federation, Serbia,[39] South Africa,[40], Singapore,[41] Spain, Sri Lanka,[42] Sweden,[43] Switzerland, Taiwan, Thailand,[44] Turkey,[45] Ukraine,[46] the United Kingdom,[47] and the United States.[7]Franchise fraud is defined by the United States Federal Bureau of Investigation as a pyramid scheme. The FBI website states:

Pyramid schemes—also referred to as franchise fraud or chain referral schemes—are marketing and investment frauds in which an individual is offered a distributorship or franchise to market a particular product. The real profit is earned, not by the sale of the product, but by the sale of new distributorships. Emphasis on selling franchises rather than the product eventually leads to a point where the supply of potential investors is exhausted and the pyramid collapses.[48]

Notable recent cases

The 1997 rebellion in Albania was partially motivated by the collapse of Ponzi schemes; however, they were widely referred to as pyramid schemes due to their prevalence in Albanian society.[49]In 2003, the United States Federal Trade Commission (FTC) disclosed what it called an Internet-based "pyramid scam." Its complaint states that customers would pay a registration fee to join a program that called itself an "internet mall" and purchase a package of goods and services such as internet mail, and that the company offered "significant commissions" to consumers who purchased and resold the package. The FTC alleged that the company's program was instead and in reality a pyramid scheme that did not disclose that most consumers' money would be kept, and that it gave affiliates material that allowed them to scam others.[50]

WinCapita was a scheme run by Finnish criminals that involved about €100 million. The scheme started in 2005.[51]

In early 2006, Ireland was hit by a wave of schemes with major activity in Cork and Galway. Participants were asked to contribute €20,000 each to a "Liberty" scheme which followed the classic eight-ball model. Payments were made in Munich, Germany to skirt Irish tax laws concerning gifts. Spin-off schemes called "Speedball" and "People in Profit" prompted a number of violent incidents and calls were made by politicians to tighten existing legislation.[52] Ireland has launched a website to better educate consumers to pyramid schemes and other scams.[53]

On 12 November 2008, riots broke out in the municipalities of Pasto, Tumaco, Popayan and Santander de Quilichao, Colombia after the collapse of several pyramid schemes. Thousands of victims had invested their money in pyramids that promised them extraordinary interest rates. The lack of regulation laws allowed those pyramids to grow excessively during several years. Finally, after the riots, the Colombian government was forced to declare the country in a state of economic emergency to seize and stop those schemes. Several of the pyramid's managers were arrested, and are being prosecuted for the crime of "illegal massive money reception."[54]

The Kyiv Post reported on 26 November 2008 that American citizen Robert Fletcher (Robert T. Fletcher III; aka "Rob") was arrested by the SBU (Ukraine State Police) after being accused by Ukrainian investors of running a Ponzi scheme and associated pyramid scam netting US$20 million. (The Kiev Post also reports that some estimates are as high as US$150 million.)[55]

In the United Kingdom in 2008 and 2009, a £21 million pyramid scheme named 'Give and Take' involved at least 10,000 victims in the south-west of England and South Wales. Leaders of the scheme were prosecuted and served time in jail before being ordered to pay £500,000 in compensation and costs in 2015. The cost of bringing the prosecution was in excess of £1.4 million.[56]

Throughout 2010 and 2011 a number of authorities around the world including the Australian Competition and Consumer Commission, the Bank of Namibia and the Central Bank of Lesotho have declared TVI Express to be a pyramid scheme. TVI Express, operated by Tarun Trikha from India has apparently recruited hundreds of thousands of "investors", very few of whom, it is reported, have recouped any of their investment.[57][58][59][60][61] In 2013, Tarun Trikha was arrested at the IGI Airport in New Delhi.[62]

BurnLounge, Inc. was a multi-level marketing online music store founded in 2004 and based in New York City. By 2006 the company reported 30,000 members using the site to sell music through its network. In 2007 the company was sued by the Federal Trade Commission for being an illegal pyramid scheme. The company lost the suit in 2012, and lost appeal in June 2014. In June 2015, the FTC began returning $1.9 million to people who had lost money in the scheme.[63]

In August 2015, the FTC filed a lawsuit against Vemma Nutrition Company, an Arizona-based dietary supplement MLM accused of operating an illegal pyramid scheme. In December 2016, Vemma agreed to a $238 million settlement with the FTC, which banned the company from "pyramid scheme practices" including recruitment-focused business ventures, deceptive income claims, and unsubstantiated health claims.[64][65]

In March 2017, Ufun Store registered as an online business for its members as a direct-sales company was declared operating a pyramid scheme in Thailand. The Criminal Court handed down prison terms totaling 12,265 to 12,267 years to 22 people convicted over the scheme, which conned about 120,000 people out of more than 20 billion baht[66].

See also

- Gift

- Ponzi Scheme

- Claims of Social Security in the USA as a pyramid scheme

- Aman Futures Group

- BurnLounge

- The Cobra Group

- Holiday Magic

- Make Money Fast

- Nouveau Riche (college)

- Qnet

- Success University

References

- Limited, Bangkok Post Public Company. "Ufun fraudsters sentenced to thousands of years". https://www.bangkokpost.com. Retrieved 2018-05-20. External link in

|work=(help)

- The Fraudsters: How Con Artists Steal Your Money, Chapter 9, "Pyramids of Sand" (ISBN 978-1-903582-82-4) by Eamon Dillon, published September 2008 by Merlin Publishing, Ireland.

External links

Media related to Pyramid and Ponzi schemes at Wikimedia Commons

Media related to Pyramid and Ponzi schemes at Wikimedia Commons

Languages

There are multi-level marketing plans – and then there are pyramid schemes. Before signing on the dotted line, study the company’s track record, ask lots of questions, and seek out independent opinions about the business.

Bell System

The Bell System was the system of companies, led by the Bell Telephone Company and later by AT&T, which provided telephone services to much of the United States and Canada from 1877 to 1984, at various times as a monopoly. On December 31, 1983, the system was divided into independent companies by a U.S. Justice Department mandate.The general public in the United States often used the colloquial term Ma Bell (as in "Mother Bell") to refer to any aspect of this conglomerate, as it held a near-complete monopoly over telephone service in most areas of the country, and is still used by many to refer to any telephone company. Ma Bell is also used to refer to the various female voices in recordings for the Bell System: Mary Moore, Jane Barbe, and Pat Fleet, the current voice of AT&T.

Contents

History

Logo used from 1889 to 1900

In 1899, American Telephone & Telegraph (AT&T) acquired the assets of its parent, the American Bell Telephone Company. American Bell had created AT&T to provide long-distance calls between New York and Chicago and beyond. AT&T became the parent of American Bell Telephone Company, and thus the head of the Bell System, because regulatory and tax rules were leaner in New York than in Boston, where American Bell was headquartered. Later, the Bell System and its moniker "Ma Bell" became a term that referred generally to all AT&T companies of which there were four major divisions:

- AT&T Long Lines, providing long lines to interconnect local exchanges and long-distance calling services

- Western Electric Company, Bell's equipment manufacturing arm

- Bell Labs, conducting research and development for AT&T

- Bell operating companies, providing local exchange telephone services.

Formation under Bell patent

Receiving a U.S. patent for the invention of the telephone on March 7, 1876, Alexander Graham Bell formed the Bell Telephone Company in 1877, which in 1885 became AT&T.[2][3][4]When Bell's original patent expired 15 years later in 1894, the telephone market opened to competition and 6,000 new telephone companies started while the Bell Telephone company took a significant financial downturn.[2][4]

On April 30, 1907, Theodore Newton Vail returned as President of AT&T.[2][4] Vail believed in the superiority of one national telephone system and AT&T adopted the slogan "One Policy, One System, Universal Service."[2][5] This became the company's philosophy for the next 70 years.[4] Under Vail, AT&T began acquiring many of the smaller telephone companies including Western Union telegraph.[2][4] Anxious to avoid action from government antitrust suits, AT&T entered into an agreement known as the Kingsbury Commitment with the federal government.[2][5]

Kingsbury Commitment

Following a government antitrust suit in 1913, AT&T agreed to the Kingsbury Commitment in which AT&T would sell its $30 million in Western Union stock, allow competitors to interconnect with its system, and not acquire other independent companies without permission from the U.S. Interstate Commerce Commission (ICC).[2][4][6]

Bell System trademark used by AT&T and affiliated companies from 1921 to 1939

195 Broadway, headquarters for most of the 20th century

The Spirit of Communication as used on the Bell System's directories in the 1930s–40s

Nationwide monopoly

Bell system telephones and related equipment were made by Western Electric, a wholly owned subsidiary of AT&T Co. Member telephone companies paid a fixed fraction of their revenues as a license fee to Bell Labs.As a result of this vertical monopoly, by 1940 the Bell System effectively owned most telephone service in the United States, from local and long-distance service to the telephones themselves. This allowed Bell to prohibit its customers from connecting phones not made or sold by Bell to the system without paying fees. For example, if a customer desired a type of phone not leased by the local Bell monopoly, he or she had to purchase the phone at cost, give it to the phone company, then pay a 're-wiring' charge and a monthly lease fee in order to use it.

In 1949, the United States Department of Justice alleged in an antitrust lawsuit that AT&T and the Bell System operating companies were using their near-monopoly in telecommunications to attempt to establish unfair advantage in related technologies. The outcome was a 1956 consent decree limiting AT&T to 85% of the United States' national telephone network and certain government contracts, and from continuing to hold interests in Canada and the Caribbean. The Bell System's Canadian operations included the Bell Canada regional operating company and the Northern Electric manufacturing subsidiary of the Bell System's Western Electric equipment manufacturer. Western Electric divested Northern Electric in 1956, but AT&T did not divest itself of Bell Canada until 1975. ITT Corporation, then known as International Telephone & Telegraph Co. purchased the Bell System's Caribbean regional operating companies.

The Bell System also owned various Caribbean regional operating companies, as well as 54% of Japan's NEC and a post-World War II reconstruction relationship with NTT before the 1956 boundaries were emplaced. Before 1956, the Bell System's reach was truly gargantuan. Even during the period from 1956 to 1984, the Bell System's dominant reach into all forms of communications was pervasive within the United States and influential in telecommunication standardization throughout the industrialized world.

The 1984 Bell System divestiture brought an end to the affiliation branded as the Bell System. It resulted from another antitrust lawsuit filed by the U.S. Department of Justice in 1974, alleging illegal practices by the Bell System companies to stifle competition in the telecommunications industry. The parties settled the suit on January 8, 1982, superseding the former restrictions that AT&T and the DOJ had agreed upon in 1956.

Present-day usage of the Bell name

The Bell System service marks, including the circled-bell logo, especially as redesigned by Saul Bass in 1969, and the words Bell System in text, were used before January 1, 1984, when the AT&T divestiture of its regional operating companies took effect. Currently, the word mark Bell, the logo, and other related trademarks, are held by each of the remaining Bell companies, namely AT&T, Verizon, CenturyLink, and Cincinnati Bell.[7] International rights to the marks, except for Canada, are held by a joint venture of these companies, Bell IP Holdings.Of the various resulting 1984 spinoffs, only BellSouth actively used and promoted the Bell name and logo during its entire history, from the 1984 break-up to its merger with the new AT&T in 2006. Similarly, cessation of using either the Bell name or logo occurred for many of the other companies more than a decade after the 1984 break-up as part of an acquisition-related rebranding. The others have only used the marks on rare occasions to maintain their trademark rights, even less now that they have adopted names conceived long after divestiture. Examples include Verizon, which still used the Bell logo on its trucks and payphones until it updated its own logo in 2015, and Qwest, formerly US West, which licenses the Northwestern Bell and Mountain Bell names to Unical Enterprises, who makes telephones under the Northwestern Bell name.

Cincinnati Bell, a local franchise of the Bell System that was never wholly owned by AT&T and existed separately prior to 1984, also continues to use the Bell name. It stopped using the Bell logo in the summer of 2006, though it is still seen on some bills, vehicles, and other literature.[citation needed]

In 1984, each regional Bell operating company was assigned a set list of names it was allowed to use in combination with the Bell marks. Aside from Cincinnati Bell, all these Bell System names have disappeared from the United States business landscape. Southwestern Bell used both the Bell name and the circled-bell trademark until SBC opted for all of its companies to do business under the "SBC" name in 2002. Bell Atlantic used the Bell name and circled-bell trademark until renaming itself Verizon in 2000. Pacific Bell continued operating in California under that name (or the shortened "PacBell" nickname) until SBC purchased it.

In Canada, Bell Canada (divested from AT&T in 1975) continues to use the Bell name. For the decades that Nortel was named Northern Telecom, its research and development arm was Bell Northern Research. Bell Canada and its holding-company parent, Bell Canada Enterprises, still use the Bell name and used variations of the circled-bell logo until 1977, which until 1976 strongly resembled the 1921 to 1939 Bell System trademark shown above.

Subsidiaries

Pre-1956 international holdings

Before the 1956 break-up, the Bell System included the companies listed below, plus those listed in the pre-1984 section. Northern Electric, and the Caribbean regional operating companies were considered part of the Bell System proper before the 1956 break-up. Nippon Electric was considered a more distant affiliate of Western Electric than Northern Electric, where Nippon Electric via its own research and development adapted the designs of Western Electric's North American telecommunications equipment for use in Japan, which to this day gives much of Japan's telephone equipment and network a closer resemblance to North American ANSI and Telcordia standards than to European-originated ITU-T standards. Before the 1956 break-up, Northern Electric was predominantly focused only on manufacturing, without any significant amount of telecommunication-equipment research & development of its own. The post-World War II-occupation operation of Japan's NTT was considered an administrative adjunct to the North American Bell System.- Nortel Networks Corporation, formerly Northern Telecom, an equipment-manufacturing company

- Northern Electric, a former telecommunications equipment-manufacturing subsidiary of Western Electric

- Dominion Electric, a former recording equipment-manufacturing company

- Various former Caribbean regional operating companies, sold to ITT

- NEC, a currently existing equipment-manufacturing company in Japan

- Nippon Electric, a former telecommunications equipment-manufacturing company 54% owned by Western Electric

- NTT, a currently existing telecommunications company in Japan that was administered by AT&T as part of General Douglas MacArthur's post-WWII reconstruction

Manhole cover with Bell System logo

Pre-1984 breakup

Immediately before the 1984 break-up, the Bell System had the following corporate structure:- American Telephone and Telegraph Company, a holding company and long-distance carrier

- Illinois Bell Telephone Company

- Indiana Bell Telephone Company, Incorporated

- Michigan Bell Telephone Company

- New England Telephone and Telegraph Company

- New Jersey Bell Telephone Company

- New York Telephone Company

- Northwestern Bell Telephone Company

- Pacific Northwest Bell Telephone Company

- South Central Bell Telephone Company

- Southern Bell Telephone and Telegraph Company

- Southwestern Bell Telephone Company

- The Bell Telephone Company of Pennsylvania

- The Chesapeake and Potomac Telephone Company

- The Chesapeake and Potomac Telephone Company of Maryland

- The Chesapeake and Potomac Telephone Company of West Virginia

- The Chesapeake and Potomac Telephone Company of Virginia

- The Diamond State Telephone Company

- The Mountain States Telephone and Telegraph Company

- The Ohio Bell Telephone Company

- The Pacific Telephone and Telegraph Company

- Wisconsin Telephone Company

- Other subsidiaries:

- Bell Canada (1880–1975)

- Northern Electric (equipment manufacturing in Canada) (1914–1956)

- Western Electric Co., Inc. (equipment manufacturing)

- Bell Telephone Laboratories, Inc. (R&D (research & development), co-owned between AT&T and Western Electric)

- Cincinnati Bell, Inc. (22.7% owned)

- The Southern New England Telephone Company (16.8% owned)

- Bellcomm, Inc. (1963–1972; formed to support the Apollo program)

- Bell Canada (1880–1975)

1984

On January 1, 1984, the former components of the Bell System were structured into the following companies, which became known as the Baby Bells.- American Information Technologies Corporation, branded as Ameritech

- Illinois Bell Telephone Company

- Indiana Bell Telephone Company, Incorporated

- Michigan Bell Telephone Company

- The Ohio Bell Telephone Company

- Wisconsin Bell, Inc.

- American Telephone and Telegraph Company

- AT&T Communications, Inc.

- AT&T Information Systems, Inc.

- AT&T Technologies, Inc.

- Bell Telephone Laboratories, Inc.

- Bell Atlantic Corporation

- New Jersey Bell Telephone Company

- The Bell Telephone Company of Pennsylvania

- The Chesapeake and Potomac Telephone Company

- The Chesapeake and Potomac Telephone Company of Maryland

- The Chesapeake and Potomac Telephone Company of West Virginia

- The Chesapeake and Potomac Telephone Company of Virginia

- The Diamond State Telephone Company

- Bell Communications Research, Inc., owned equally by all the Baby Bells

- BellSouth Corporation

- Southern Bell Telephone and Telegraph Company

- South Central Bell Telephone Company

- Cincinnati Bell, Inc.

- Cincinnati Bell Telephone Company

- NYNEX Corporation

- Pacific Telesis Group

- Pacific Bell Telephone Company

- Nevada Bell Telephone Company

- Pacific Bell Telephone Company

- Southwestern Bell Corporation

- Southwestern Bell Telephone Company

- The Southern New England Telephone Company

- U S WEST, Inc.

- Northwestern Bell Telephone Company

- Pacific Northwest Bell Telephone Company

- The Mountain States Telephone and Telegraph Company

- Malheur Home Telephone Company

Today

After 1984, there were multiple mergers of the operating companies themselves, as well as multiple Baby Bells that came together, and some components are now in the hands of companies independent from the historic Bell System. The structure of the companies today[when?] is as follows.- Remaining "Regional Bell Operating Companies"

- AT&T Inc., a currently existing holding company

- AT&T Corp., a current subsidiary

- AT&T Teleholdings, Inc. (formerly Ameritech Corporation), a current subsidiary, also includes now defunct Pacific Telesis

- Illinois Bell Telephone Company, a currently existing regional LEC

- Indiana Bell Telephone Company, Incorporated, a currently existing regional LEC

- Michigan Bell Telephone Company, a currently existing regional LEC

- Pacific Bell Telephone Company, a currently existing regional LEC

- Nevada Bell Telephone Company, a currently existing regional LEC, omitted from the MFJ

- The Ohio Bell Telephone Company, a currently existing regional LEC

- Wisconsin Bell, Inc., a currently existing regional LEC

- BellSouth Corporation, a current subsidiary. Its two operating companies merged into one:

- BellSouth Telecommunications, LLC, a currently existing regional LEC, includes Southern Bell & South Central Bell

- Southwestern Bell Telephone Company, a currently existing regional LEC

- Verizon Communications, Inc., formerly Bell Atlantic Corporation, a currently existing holding company

- NYNEX Corporation, a former RBOC holding company

- Verizon New England, Inc., a currently existing regional LEC

- Verizon New York, Inc., a currently existing regional LEC

- Verizon Delaware LLC, a currently existing regional LEC

- Verizon Maryland, Inc., a currently existing regional LEC

- Verizon New Jersey, Inc., a currently existing regional LEC

- Verizon Pennsylvania, Inc., a currently existing regional LEC

- Verizon Washington, D.C., Inc., a currently existing regional LEC

- Verizon Virginia, Inc., a currently existing regional LEC

- NYNEX Corporation, a former RBOC holding company

- CenturyLink, Inc., a currently existing independent LEC holding company

- Qwest Communications International, Inc., a holding company acquired in 2011; originally a non-Bell company, acquired and merged U S WEST in 2000.

- Qwest Services Corporation, a holding company within the Qwest corporate structure

- Qwest Corporation, a currently existing regional LEC, originally Mountain Bell, includes defunct Malheur Bell, Northwestern Bell, Pacific Northwest Bell

- Qwest Services Corporation, a holding company within the Qwest corporate structure

- Qwest Communications International, Inc., a holding company acquired in 2011; originally a non-Bell company, acquired and merged U S WEST in 2000.

- Other "Bell Operating Companies"

Cincinnati Bell's alternative logo retains the iconic Bell logo.

- Cincinnati Bell, Inc., a currently existing independent LEC holding company

- Cincinnati Bell Telephone Company LLC, a currently existing LEC of which AT&T owned 27.8% before 1984 and thus was left separate in the 1984 break-up

- Consolidated Communications Holdings, Inc., a currently existing independent LEC holding company

- FairPoint Communications, Inc., an LEC holding company sold to Consolidated in 2017

- Northern New England Telephone Operations LLC, a regional LEC created when Verizon New England lines in Maine and New Hampshire were sold to FairPoint in 2008

- Telephone Operating Company of Vermont LLC, a regional LEC created when Verizon New England lines in Vermont were sold to FairPoint in 2008

- FairPoint Communications, Inc., an LEC holding company sold to Consolidated in 2017

- Frontier Communications Corporation, a currently existing independent LEC holding company

- Frontier Communications ILEC Holdings, Inc., an LEC holding company created by Verizon and sold to Frontier in 2010

- Frontier West Virginia, Inc., a currently existing regional LEC, formerly C&P Telephone of West Virginia

- The Southern New England Telephone Company, a currently existing regional LEC that AT&T owned 16.8% of before 1984 and thus was left separate by the 1984 break-up

- Frontier Communications ILEC Holdings, Inc., an LEC holding company created by Verizon and sold to Frontier in 2010

- Other "Bell System" companies

- Lucent Technologies, a research and equipment manufacturing company spun-off in 1995; merged with French company Alcatel in 2006 to form Alcatel-Lucent which was acquired by Finland's Nokia Corporation in 2016

- Western Electric Company, Incorporated, a former telecommunications and recording equipment-manufacturing company that ceased to have that name as of the 1984 break-up

- Bell Telephone Laboratories, Inc., the former AT&T-corporate research unit known as Bell Labs: also spun-off to Lucent Technologies, became Nokia Bell Labs in 2016

- Avaya, Inc., a currently-existing equipment manufacturing company spun-off from Lucent in 2000

- LSI Corporation, a currently existing holding company

- Agere Systems, incorporated in 2000, the former Micro Electronics subsidiary of Lucent; was then spun-off in 2002 and acquired by LSI in 2007

- Systimax Solutions, the Western Electric Structured Cabling unit, once known as AT&T Network Systems was spun-off from Avaya in 2002 and is now part of CommScope

- Telefonaktiebolaget L. M. Ericsson, a Swedish communications company

- Telcordia Technologies, Inc., a currently existing research company, formerly known as Bell Communications Research (Bellcore)

See also

- Bell Telephone Memorial

- Independent telephone company

- RBOC (Regional Bell Operating Company)

- The Telephone Cases

References

- USPTO record for trademark serial no. 73727728 (example "Bell" registration originally held by Pacific Telesis): "Registration is nationwide, but is subject to the condition that registrant shall use the mark only in conjunction with one or more of the following modifiers; "Nevada Bell", "Pacific Bell", "Pacific Telephone", "Pacific Telesis", or "PacTel". Use of a modifier shall be considered to be in conjunction with the mark if it is used in sufficient proximity to the mark such that a reasonable observer would normally view the mark and the modifier in a single visual impression and would recognize that both the mark and the modifier are used by registrant. Registrant's right to exclusive use of the mark is subject to the rights of the [other RBOCs], to which concurrent registrations in the mark have also been issued, to use the mark in conjunction with one or more of the modifiers specified in those registrations[...]"

This article needs additional citations for verification. (January 2008) (Learn how and when to remove this template message)

|

External links

- Bell.com

- Bell System Memorial

- Blue Bell Telephone Sign History — New England Telephone and Telegraph

- Archive of Bell System Intercept Messages

- AT&T Corporation (1885–2005 company) History

- BellSouth vs. FCC — reference for company names

- USPTO — see trademark database

Categories:

- Alexander Graham Bell

- American companies established in 1921

- Bell System

- Defunct companies based in New York City

- Defunct telecommunications companies of the United States

- Former AT&T subsidiaries

- Technology companies disestablished in 1984

- Holding companies disestablished in the 20th century

- Holding companies established in 1921

- Telecommunications companies established in 1921

- Telecommunications monopolies

No comments:

Post a Comment